Tuesday, March 24, 2020

Do Your Part to Recognize and Report Health Care Fraud

By Cathy Safran

Health care claims are more expensive than ever (many exceeding $1 million). In this industry, we frequently see the impact catastrophic claims could have, and it’s our job to help protect our clients’ financial stability should they face them. To make matters worse, some statistics I have heard in training seminars show that up to 10 cents of every dollar spent on health care goes toward paying for fraudulent health care claims.

Fraud encompasses human error, waste and targeted fraud schemes, and it’s not always easy to spot. But, when you take a moment to really consider that approximately 10 percent of heath care spending could be tied to fraud, especially in a time when high-dollar claims are increasing for various other reasons, action has to be taken to mitigate it.

Third Party Administrators (TPAs) may find this to be challenging, as they receive large amounts of data and feel pressure to pay claims quickly, but it doesn’t mean signs should be ignored. Some things to do may include:

Acknowledge that fraud exists

Be aware of the types of schemes people use to commit fraud

Apply data analytics to identify possible anomalies that would point to fraud

Know how to report fraud to the proper authorities

Fraud Exists

In reality, health care fraud seems to be perpetrated by a few dishonest individuals, care providers and/or administrators looking to unlawfully gain financially. That small group, however, creates a huge problem. Health care fraud can occur through a number of situations ranging from unnecessary and duplicate tests or procedures to stealing a patient’s identity and medical history in order to submit false claims.

There Are Many Ways Fraud Is Committed

People will go to great lengths to perpetrate fraud, and that type of dishonest behavior appears to be commonly driven by two factors: the likelihood of getting caught and whether or not the reward outweighs the risk. People make that decision according to their personal risk threshold.

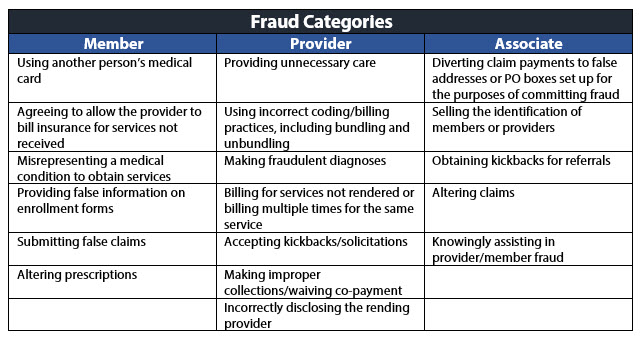

I have found that health care fraud generally falls into three categories – member, provider and associate – and these groups commit fraud through several common schemes. Review the chart below to learn more.

Data Analytics Can Help Point to Fraud Claims

Claims professionals are the front line of defense against fraud. They have the opportunity to ask questions and can use their “sixth sense” to identify fraud indicators. There are a number of resources available to help claims professionals gain knowledge of red flags (warning signs). But keep in mind, not all red flags signify that fraud or abuse has actually occurred, they simply offer a helpful way to point to potential instances.

One smart way to help detect if fraud schemes are being used is through data analytics, which comes in two forms: descriptive and predictive.

Descriptive analytics uses the interpretation of historical data to better recognize changes that have occurred, helping observers to draw conclusions about a particular situation.

Predictive analytics uses a range of statistical techniques like data mining, predictive modeling and machine learning to analyze facts and make predictions.

Both descriptive and predictive analytics can help to detect anomalies and variances in claims data to uncover outliers in claims, benchmark procedure codes and costs against comparable claims and notice attributes that contribute to the anomaly.

Fraud Must Be Reported

Once the potential anomaly is identified, investigated and determined to be fraud, it must be reported. TPAs can work with their own Special Investigation Unit (SIU) or access an SIU vendor to report the fraud to the proper authorities, keeping in mind that each state has its own reporting requirements. Detecting and reporting fraud is another way to gain better control of claim costs and help guard the financial health of the clients entrusting us to do so.

For potential fraud associated with HM Stop Loss business, HM Insurance Group offers a Fraud Hotline at 888-842-5699, as well as a dedicated Fraud Contact form for reaching our Special Investigation Unit.

Why HM

A strong, experienced carrier, HM responds to market changes and works with clients to ensure their coverage needs are met through expert risk assessment and exceptional service.