Tuesday, July 16, 2019

What Does Unlimited Mean?

By Mark Lawrence

At HM Insurance Group (HM), we’re very proud of our financial strength. Our Stop Loss paper is rated “A” by AM Best, and we have a combined surplus of more than $1,000,000,000. That’s a lot of zeroes. This capital is the financial bedrock of the promise we make to employer groups – we will pay their claims.

The Stop Loss market has changed a lot in the past ten years. Prior to the passage of the Affordable Care Act (ACA) in 2010, we issued limited policies, meaning they had annual or lifetime policy maximums of $1,000,000 or $2,000,000. As an underwriter at that time, it was hard to envision claims reaching those policy limits. But now it’s something that happens with frequency.

High-Dollar Claim Growth

Since 2010, we’ve seen a tremendous increase in the sophistication and cost of medical technology. Most recently, a new class of “gene therapies” has come to market. Essentially, these “drugs” delete a damaged or mutated sequence of DNA and replace them with an appropriate or correct sequence. Some current examples include Luxturna® for blindness, CAR T-cell therapies (PDF) for certain cancers and Zolgensma® for Spinal Muscular Atrophy (PDF) – and all of these therapies come with price tags nearing, exceeding or well exceeding $1 million. While these drugs are in the market currently, there are dozens more in the pipeline. Not all of these will come to market, but there will be more of these drugs for sale each year for the foreseeable future.

Cost Evolution

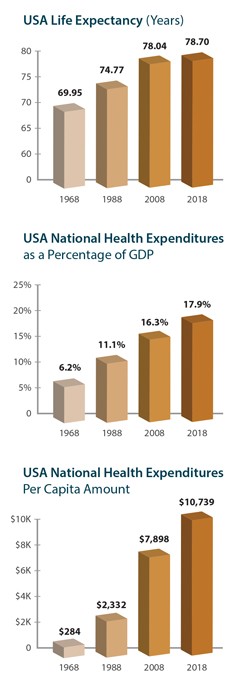

I think that numbers tell the story in a way that words sometimes cannot. Since I was born in 1968, I’ll start there. I went back and pulled some information – primarily from CMS (Centers for Medicare and Medicaid Services) – and while there are some caveats that should go with these charts, they help to demonstrate how a few key factors have influenced the cost progression that has gotten us to this point.

While there has been a meaningful, but flattening increase in life expectancy in the 50 years between 1968 and 2018 (8.75 years), our health care spending as a percentage of GDP has increased almost three times (from 6.2 percent to 17.9 percent).

And our per capita spending on health care dollars has increased 37.8 times over the same period.

The advances we’ve seen in medicine and technology have provided tremendous benefits for individuals and society as a whole – there is no disputing that. However, they come at a cost.

In the Stop Loss business, we see those costs passed on in the form of large claims received from hospitals (where the medical technology resides) and pharmaceutical companies (who have produced the gene therapies and other novel medications). With these developments, in combination with the removal of policy limits, large claims have grown in both frequency and severity.

Risk Pooling

One of the fundamental concepts of insurance is the pooling of risk. I discussed this in a prior blog about how Lloyd’s of London started among ship owners in 1686. While the loss of a ship due to a storm may have been devastating to an individual who owned one or two ship(s), it was not devastating when spread across 20 or 30 ship owners.

In discussions we’ve had with the pharmaceutical industry and some brokers, they’d like us to create a “high risk pool” to deal with these claims. A pool would separate high-dollar claims from our “normal” business and allow us to consider our results on a “what if” underwriting basis – “what if” these large claims were removed from our base business? Would we see fewer large claims? Would there be better financial results or lower rate increases? Back in the real world, these claims are incurred and paid (by the employer group in amounts up to the Spec deductible and by HM in excess of the Spec deductible) using real cash dollars. They need to be accounted for whether or not these claims reside in separate risk pools or in our overall block of business.

From my perspective, there are two main issues that work against the creation of a separate high risk pool for these high-cost treatments. First is selection. Unless participation in a separate risk pool is compulsory, there will be a limitless supply of companies and individuals who believe that paying money to the pool – to fund claims they may never incur – is a waste of money. Those that actually have the claims will pay all the freight, and the cost will be prohibitive for those participating.

The second issue is math. If the sum of all claims to a Stop Loss company like HM Insurance Group is represented by A, attritional claims by B, and high-dollar claims by C, then B + C = A. There are no dollars gained or lost in the chopping up of claims into component parts. However, there are administrative expenses and capital considerations that go with a separate high-dollar risk pool, so, in theory, a separate high-dollar pool could raise costs in total.

The Reality of the Trends

Stop Loss insurance rates are a reflection of the cost of excess claims. Excess claims have increased in frequency and severity. Therefore, Stop Loss insurance rates have increased to reflect those increasing costs – that is reality. The nature of Medical Stop Loss insurance is such that a single employer’s results are not fully credible, in part because the largest claims are infrequent, unpredictable and so large that most employers could not fund them fully, even over several years.

At HM, we’re big enough to fund these high-dollar medical claims by spreading the costs throughout our entire block, and funding high-dollar claims across HM’s block of business is a fair way to distribute the costs of the most expensive medical treatments and drugs across all employers in the block.

However, in the longer term, as costs continue to increase and mortality improvements slow, we (collectively – as a society) will be forced to confront the issue of how to balance the costs and benefits.

Why HM

A strong, experienced carrier, HM responds to market changes and works with clients to ensure their coverage needs are met through expert risk assessment and exceptional delivery of benefits.